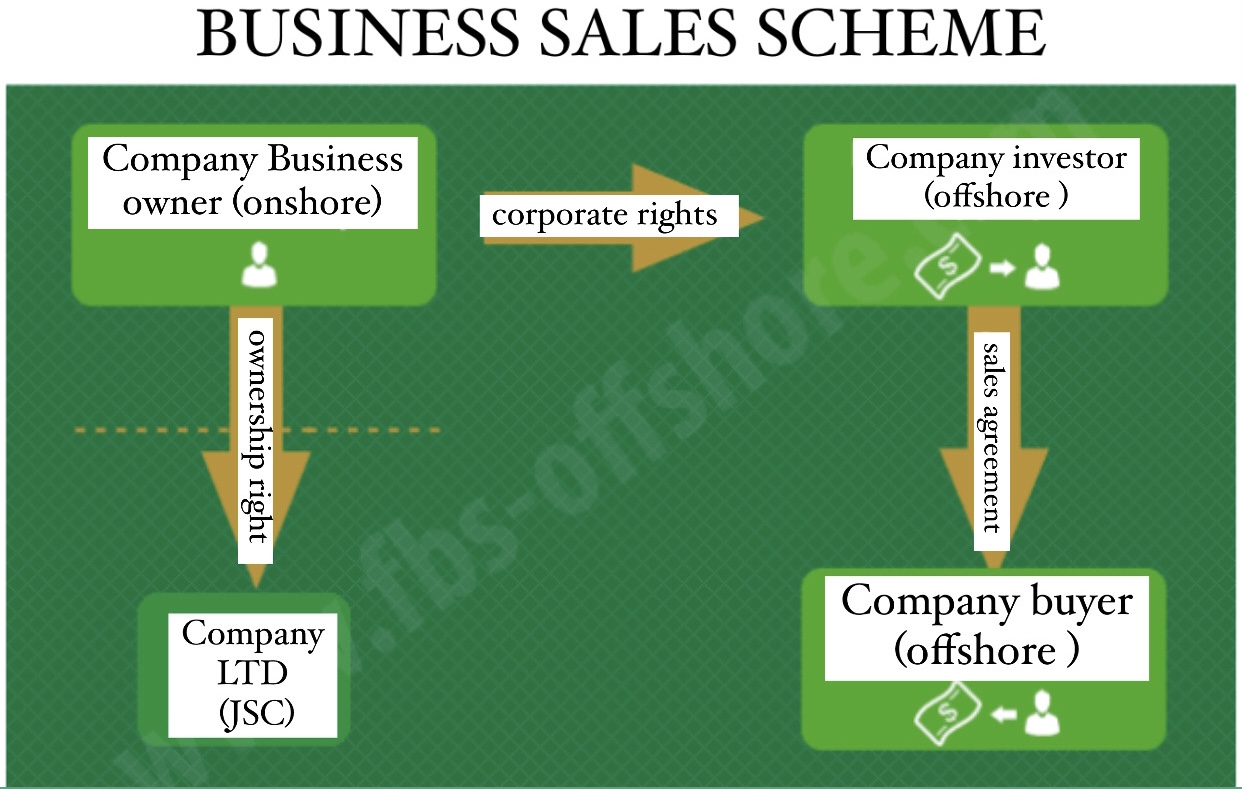

Scheme of selling a business abroad

When selling a business may look different, consider the options.

Sale of shares

One of the options is the sale of shares, which is carried out on the basis of a sale and purchase agreement, after which an appropriate entry is made in the register of shareholders. At the same time, the seller must take into account the income received from the sale of shares when calculating income tax.

Sale of the enterprise as a property complex.

This sale involves the transfer to the buyer of an enterprise as:

- all types of property intended for the activities of the enterprise, including land, buildings, structures, equipment, inventory, raw materials, finished products;

- receivables and payables of the enterprise for its civil obligations;

- rights of claim on the basis of obligations in which the seller acts as a creditor;

- rights to intangible assets, namely those belonging to the seller for the use of such means of individualization.

When using this method of selling a business, the selling organization has the following tax consequences: the obligation to calculate and pay VAT, the obligation to calculate and pay income tax.

All these taxes can be optimized using non-resident companies. First of all, a non-resident onshore company (a company in Cyprus, the UK, Switzerland, Denmark…) acquires 100% of the corporate rights of an LLC or a block of shares. Thus, the company becomes the owner of the Ukrainian company. Moreover, it should be noted that in order to ensure confidentiality, an offshore company (Panama, Belize, Seychelles ...) acts as a shareholder of an onshore company. After that, the company sells the business of the company to the buyer according to the contract. It is possible to sell the corporate rights (shares) of an onshore company of another company to a non-resident. When constructing this kind of circuits, we strongly recommend that you consult with specialists.