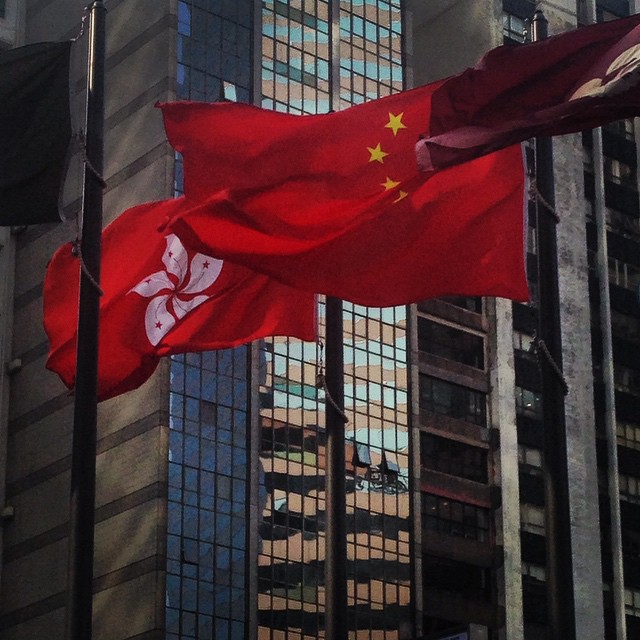

DTA entered into force between Russia and Hong Kong

Comprehensive agreement for the avoidance of double taxation (CDTA) was signed in January of this year between Hong Kong and Russia, which came into force on 29 July 2016. According to the sources, this agreement shall remain in force for Hong Kong each year since its signing to double taxation, which took place on or after April 1, 2017. The CDTA is informed about what is required to support efforts to expand the tax obligations undertaken by the two countries in the framework of the «Belt and Road», which is a project of the Chinese government for the economic development aiming at the integration of trade and investment between the approximately 60 countries in Eurasia. In the absence of the CDTA program, of Hong Kong companies income, which conduct their entrepreneurial activities with the help of permanent missions in Russia and taxed in both places if their earnings was received in Hong Kong. On this basis, in the new agreement, double taxation is eliminated, and now any Russian tax paid by the companies on their earnings, will be allowed to tax payable in Hong Kong. Besides, in accordance with this agreement, the rate in Russia on income tax on royalties, up to the...