Many citizens who own residential and non-residential real estate intend to lease it. But they have some questions: is it necessary to register as an entrepreneur in this case, are there any peculiarities in taxation and are there any restrictions?

According to Art. 319, 320 of the Civil Code of Ukraine – the owner owns, uses, disposes of his property at his own discretion and has the right to make any actions with respect to his property that do not contradict the law, including using his property for entrepreneurial activities.

As we can see, the realization of the right to lease his own real estate by a natural person can be carried out both within the framework of entrepreneurial activity (by a natural person-entrepreneur) and outside of entrepreneurial activity (without registration by a natural person-entrepreneur).

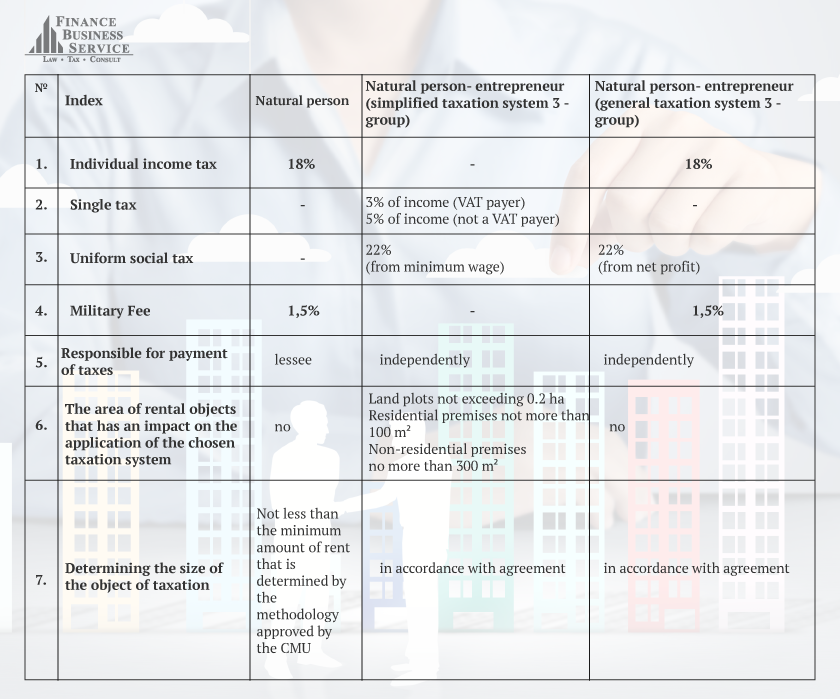

We will consider in detail, what is the difference between a natural person and a natural person-entrepreneur, when leasing his own real estate.

Natural person

The features of taxation of income of a natural person from leasing of real estate is regulated by art. 167, art. 170 of the Tax Code of Ukraine, Resolution of the Cabinet of Ministers of Ukraine No. 1253 of 29.12.2010 “On Approval of the Methodology for determining the minimum amount of rent payment for real estate of natural persons” and decision of local government (it is taken at the location of the real estate object).

According to subpar.170.1.2. paragraph 170.1. of Art. 170 of the Tax Code of Ukraine: “The tax agent of the taxpayer – lessor when calculating the income from providing the lease of real estate objects, named in subparagraph 170.1.1. of this paragraph (including the land that is under such real estate, or a household plot) is a lessee”.

The same subparagraph specifies that – the object of taxation is determined based on the amount of rent specified in the lease agreement, but not less than the minimum amount of the rent payment for a full or incomplete month of rent. The minimum amount of rent payment is determined by the methodology which is approved by the Cabinet of Ministers of Ukraine based on the minimum cost of monthly rent of one square meter of the total area of real estate, taking into account its location, other functional and qualitative indicators established by the local government of the village, settlement, city in the territory where it is located, and promulgated in the way which is the most accessible to the inhabitants of such a territorial community. If the minimum value is not established or not made public before the beginning of the reporting (tax) year, the object of taxation is determined based on the amount of rent specified in the lease.

According to subpar. 170.1.4. paragraph 170.1. Art. 170 of the Tax Code of Ukraine: “The income specified in subparagraphs 170.1.1-170.1.3 of this clause is taxed by the tax agent upon their accrual (payment) at the rate specified in clause 167.1. of Article 167 of this Code”.

According to paragraph 167.1. Art. 167 of the Tax Code of Ukraine, the tax rate is 18 percent.

According to subpar. 1.2 of cl. 16¹ of subsection 10 of Section XX of the Tax Code of Ukraine, a military fee of 1.5% is paid from the objects of taxation.

Thus, the current legislation of Ukraine, to date, assumes that:

- Natural person has the right to lease a real estate owned by him on the basis of the right of ownership, without registration by a subject of entrepreneurial activity;

- The amount of taxes and fees payable on income received in the form of rent is:

- individual income tax – 18%;

- military fee – 1.5%.

- Taxes and fees of the lessor, but at his expense, are paid by the lessee, along with the payment of rent (ie, acts as a tax agent).

- The object of taxation is determined on the basis of the amount of the monthly rent specified by the parties in the contract. In order to prevent understatement of objects of taxation, the minimum amount of rent payment is determined, defined by the methodology approved by the Cabinet of Ministers of Ukraine.

- The number of objects leased and their area do not influence the order of taxation.

Natural person-entrepreneur

In order to obtain profit from the leasing of its own real estate, a natural person can be registered as a business enterprise, a natural person-entrepreneur, by stating that the main type of activity in the CFEA is class 68.20 (leasing and operation of own or leased real estate).

Taxation of a physical person-entrepreneur can be carried out by a common or simplified system.

According to paragraph 291.2. of Art. 291 of the Tax Code of Ukraine: “A simplified system of taxation, accounting and reporting is a special mechanism for levying taxes and fees that establishes the replacement of payment of individual taxes and fees specified in clause 297.1. of Article 297 of this Code for the payment of a single tax in the manner and under the terms determined by this chapter, with simultaneous conduct of simplified accounting and reporting”.

The business enterprise that leases residential and non-residential premises may be a physical person-entrepreneur on the third group.

A natural person-entrepreneur on the third group can apply a simplified taxation system, while observing the following conditions:

- natural person-entrepreneur does not use the labor of hired persons or the number of persons who are with him in labor relations is not limited;

- the volume of income within a calendar year does not exceed 5000000 UAH.

According to paragraph 291.5. of Art. 291 of the Tax Code of Ukraine – they can not be payers of a single tax of the first or third group: natural persons – entrepreneurs who lease land plots with a total area of more than 0.2 hectares, living quarters and/or parts thereof, the total area of which exceeds 100 square meters, non-residential premises (buildings, structures) and/or their parts, the total area of which exceeds 300 square meters.

If the area of real estate objects that are leased exceeds the above mentioned, then the natural person-entrepreneur can not apply a simplified taxation system, and must switch to a general taxation system.

Comparative table of taxation when leasing real estate by a natural person and natural person-entrepreneur

Thus, to date, the procedure for paying taxes, their amount and administration, as well as filing the tax reports, do not always make reasonable the registration of a natural person as a business enterprise for leasing his own real estate.