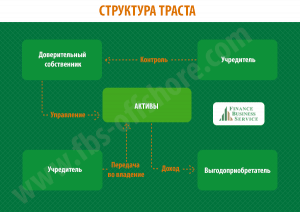

A founder (who can be also a beneficiary), under a special agreement passes the valuables to the control of a trustee, who shall perform operations with them, bringing the maximum profit to the beneficiaries or other, relevant to instructions of the founder.

Trustee services are paid by the beneficiaries or trust founder, usually as a percentage of the profits.

The object of trust can be any property, both movable and immovable. The property expressly prohibited by the legislation of trust’s country of foundation is excluded from this relationship.

The founder may transfer his property during his lifetime (lifetime trust), and provide such transfer after his death (testamentary trust). The trustee is responsible for the conditions of the trust agreement and, as a rule, gets wide powers to manage the estate of the founder, but can also get specific instructions on the distribution of trust income and capital between the beneficiaries upon the occurrence of certain conditions, clearly specified by the founder. Such conditions are usually included in the so-called founder’s letter of wishes, addressed to the trustee. The founder also has the right to make provisions for the conditions of the trustee replacement, specify whether to surrender the rights to another person, and so on.

There are beneficial and target trusts (divided into a private and charity one, accordingly). Also, trusts can be divided into revocable and irrevocable. In case of the revocable trust founder is entitled after a certain period or under certain conditions to return his property. This is not possible with irrevocable trust, i.e. founder cannot get back his property.

Trust is often used in international practice purely for tax purposes. Trust, established in one of the offshore jurisdictions, allows you to transfer funds to the countries with lower taxes. Generally, it is referred to property, as the property transferred to the trust, does not belong already to any of its former owners or beneficiaries legally. The same usually applies to capital gains tax. Revenues of the beneficiary received from the trust, usually subject to taxation according to the rules of the country of residence, but only after they are actually paid to him, which allows indefinite delay of their payment and reinvest the profits. In some cases, you can get away from the inheritance tax, but it must be borne in mind that usually the transfer of property to foreign trust is subject to the gift tax. However, in each case, a careful analysis of all the tax laws of the countries, where persons related to this trust reside, is necessary.

The benefits of the trust:

Trust allows you to place a part of the property of its founder into a separate structure, thus having secured the property from the claims of creditors and government agencies;

- Trust allows you to optimize taxes;

- Trust allows you to use the assets effectively;

- Trust can act as probate.

One of the main problems of the trust lawyers is that the customer always wants to take from trust only things necessary for him – the tax opacity anti-confiscatory protection, etc., but not willing to compromise for the sake of control over the assets transferred to the trust. A real trust, protected by the courts, is obtained only if it can be proven that it is not a fiction, that the real owner of the property is the trustee (albeit to favor of a beneficiary), that the original owner has really lost all rights to the property transferred to the trust and that the beneficiary cannot control his actions.

Founder can control the trustee himself. Very often, a scheme is registered, where the trusts are controlled by offshore company and legal instruments of share control of such trust company are very strict.

Another way to control – appointment of the beneficiary to the trust protector (it is necessary to exclude him from the number of beneficiaries). If the powers of the protector, i.e. the trust controller, are wide enough (they can be of any type: the only limit is imagination of the one, who draws the Declaration of Trust), so he then controls the trust, without being neither a beneficiary, nor a founder, and nor manager.

You can control the trust through a variety of contracts, drawn up in a certain way in the interests of the real owner.

Before working with the trusts, we strongly recommend to consult with our specialist.